Views

Modern Shareholder Engagement: Trends, Challenges, and Best Practices

Shareholder engagement is a crucial aspect of modern corporate governance, focusing on fostering open communication, aligning corporate strategies with shareholder interests, and enhancing overall governance practices.

It includes various strategies and interactions between the issuer’s board or management and the shareholders to determine policies and future plans pertaining to business, social responsibility, finances, etc.

Businesses face increasing demands for transparency, accountability, and responsible management. Shareholder communications play an increasingly pivotal role in shareholder engagement and in ensuring the long-term success of a company.

In the past, shareholder engagement was just an earnings call or check box on the list of to-do’s for the issuer. However, things have changed – a 2021 survey by PwC highlighted that over half of the board members engaged directly with shareholders. Moreover, shareholder engagement has become a round-the-clock activity owing to the rise of shareholder activism.

This article explores the objectives, common strategies, challenges and popular trends shaping shareholder engagement.

What are the key drivers of effective shareholder engagement?

Effective shareholder engagement is vital for fostering strong relationships between companies and their investors. Below, we explore the key objectives that drive meaningful and impactful shareholder engagement.

Enhancing transparency

One of the primary goals of shareholder engagement is to enhance transparency between a company and its investors. Clear communication on financial performance, governance practices, and strategic decisions helps build trust and fosters an environment of openness. By engaging shareholders regularly, companies can reduce uncertainties, allowing investors to make informed decisions based on accurate, up-to-date information.

Building trust with shareholders

Trust is the cornerstone of shareholder engagement. Through consistent and honest communication, companies can foster a positive relationship with their investors. Because of this, shareholders are more likely to support governance practices and long-term strategy. Trust is especially vital in today’s world, where investors are increasingly focused on ESG issues, demanding greater accountability from the companies they support. For instance, nearly 100% of the S&P 500 companies disclose ESG-related information, highlighting the growing importance of ESG factors in shareholder engagements.

Aligning corporate strategy with shareholder expectations

Shareholder engagement helps align a company’s corporate strategy with the interests of its investors. Understanding shareholder expectations is critical in shaping decisions related to business operations, financial goals, and governance policies. By actively seeking feedback, companies can refine their strategies to ensure alignment, resulting in better investor satisfaction and, in turn, better performance in the market.

Three common methods to drive shareholder engagement

From personalised interactions to broader forums for discussion, companies can leverage various methods to strengthen relationships and foster transparency. Below, we explore three widely used approaches to enhance shareholder engagement.

Direct communication channels

Direct communication is an effective method for shareholder engagement. Companies can engage with investors via various channels, such as emails, phone calls, virtual meetings, and one-on-one discussions. These personal interactions enable a company to directly address investor concerns and clarify important matters related to the business, governance practices, and future strategies. Additionally, maintaining direct communication channels with your top shareholders can help build goodwill, manage activism and understand reasons for poor vote outcomes. Using digital shareholder insights solutions can help you identify your key shareholders and their details to enable a more tailored direct engagement strategy.

Shareholder meetings and events

AGMs and other shareholder events are traditional yet vital methods of engagement. These meetings provide a platform for your shareholders to ask questions, voice concerns, and understand the direction in which the company is heading.

With an increasing number of companies opting for virtual or hybrid meetings, shareholder engagement is becoming more accessible and inclusive, allowing investors from around the world to participate in discussions and decision-making processes. This flexibility does, however, also open up opportunities for activism against the management.

Engagement during an AGM or EGM can be heavily driven by voting outcomes. In such scenarios, solutions like Proxymity Vote Insights can be key to fostering more meaningful engagement by providing you with real-time updates on votes cast on meeting resolutions.

Surveys and feedback mechanisms

Surveys and feedback mechanisms are powerful tools for gauging shareholder sentiment and gathering insights into investor priorities. Companies can distribute surveys to their shareholders, requesting input on governance issues, business strategy, and ESG matters.

The three main stakeholders in shareholder engagement

The board of directors, investor relations teams and the shareholders themselves, each play a critical role in fostering transparency, trust, and collaboration. But, what role do these essential stakeholders play?

Board of directors

The board of directors plays a central role in shareholder engagement, as they are responsible for overseeing company management and ensuring that decisions align with shareholder interests. Engaging with the board allows shareholders to gain insights into corporate strategy and governance, while also providing feedback on key issues affecting the company. Strong relationships between the board and shareholders help promote accountability and transparency in corporate decision-making.

Investor relations teams

Investor relations (IR) teams are dedicated to managing shareholder communications and engagement. They act as the intermediary between the company and its investors, ensuring that shareholders receive timely and accurate information. IR teams are critical in maintaining open channels of communication and addressing shareholder concerns. They often play a vital role in facilitating direct communication and organising shareholder events.

Institutional vs. retail shareholders

Engaging both institutional and retail shareholders is essential for comprehensive shareholder engagement. Institutional investors typically have more influence due to their large holdings and may demand a higher level of communication regarding corporate governance, financial performance, and ESG issues. On the other hand, retail shareholders may not always have the same access to corporate decision-makers, but their collective voice still carries weight. Companies need to tailor their engagement strategies to suit the needs and preferences of both types of shareholders, ensuring inclusivity and transparency.

The role of shareholder engagement in corporate governance

Shareholder engagement is a cornerstone of effective corporate governance, fostering accountability, shaping policies, and mitigating the risks of activism. Here’s how shareholder engagement plays a pivotal role in good governance.

Strengthening accountability

If shareholder engagement is done effectively, it can help hold companies responsible for their actions. Shareholders, as key stakeholders, can influence corporate decisions, such as executive compensation, dividend policies, and major business strategies. By voting on key resolutions during a meeting, shareholders can express their opinions and kickstart early engagement on various aspects including ESG related metrics.

By maintaining an open dialogue, issuers can demonstrate their commitment to good governance practices, addressing concerns promptly, and ensuring that their actions reflect shareholder interests. Additionally, shareholder meetings, debriefings, annual plan decks etc are sort of a public review of the company’s performance, keeping them on track with the objectives.

Influencing corporate policies

Shareholder engagement can have a direct impact on corporate policies, especially when investors express concerns or advocate for changes. Shareholders may push for modifications to corporate governance structures, ESG initiatives, or other operational changes. Companies that engage with their shareholders regularly are better positioned to anticipate and respond to these demands, minimising the risk of shareholder activism or dissatisfaction.

Mitigating risks of activism

Shareholder activism has become an increasingly prominent issue in recent years. Activist shareholders seek to influence corporate policies or even force changes in management through campaigns, proxy fights, or other means.

Proactive shareholder engagement can help mitigate these risks by addressing concerns before they escalate into activism. By actively listening to shareholders and responding to their needs, companies can avoid contentious situations that could harm their reputation and business operations.

The rise in activist shareholder campaigns is exemplified by Engine No. 1’s successful proxy contest at ExxonMobil in 2021, where they secured board seats to promote climate-related reforms. Disney has also been a target, showing how shareholder activism has become a common trend and influences corporate decision-making.

Four major challenges in shareholder engagement

Navigating shareholder engagement comes with its share of complexities, from addressing diverse priorities to managing activist demands. Here’s a look at some of the key hurdles you may face and how innovative solutions are helping overcome them.

Addressing diverse shareholder interests

One of the biggest challenges in shareholder engagement is addressing the diverse interests of shareholders, particularly in the context of anti-ESG shareholder proposals.

Firms must navigate the differing priorities of institutional investors, who focus on financial performance and shareholder returns, versus retail shareholders, who emphasise social and environmental concerns. Balancing these interests requires careful consideration and ongoing dialogue, ensuring that all shareholders feel heard and valued.

Visibility of shareholders and ownership changes

Our report on Proxy Transformation in Australia and New Zealand found that lack of visibility was a key challenge for issuers. Understanding their beneficial owners becomes difficult due to outdated legacy solutions that can take up to two weeks to deliver on ID requests.

However, solutions like Proxymity Shareholder Insights, provide accurate beneficial owner data within 30 minutes of raising the request with the final output delivered in less than 3 days.

Balancing transparency and confidentiality

While transparency is essential in shareholder engagement, companies must also balance it with the need for confidentiality. Disclosing sensitive information too early or without proper consideration can have legal or financial consequences. Companies must navigate this delicate balance, ensuring that they provide shareholders with the information they need without compromising sensitive business strategies or trade secrets.

Managing activist shareholders

Dealing with activist shareholders can be challenging, particularly when their demands conflict with company strategies. While shareholder activism can sometimes lead to positive changes, it can also disrupt operations and negatively affect a company’s reputation.

Proactively engaging with shareholders and understanding their concerns is key to managing these situations effectively and avoiding unnecessary conflicts. In the US, new universal proxy rules implemented by the SEC in 2021 simplify board election processes, making proxy contests more accessible to smaller activists. This rule could lead to an increase in contested elections, empowering shareholders to have a direct say in board composition.

Best practices for effective shareholder engagement

Successful shareholder engagement hinges on clear communication, continuous dialogue, and a tailored approach to investor relationships. Here are some of the best practices to help you strengthen engagement and drive impactful results.

Proactive communication strategies

Effective shareholder engagement requires a proactive approach. Companies should establish regular communication channels to ensure that shareholders are kept informed about important developments, such as financial performance, governance issues, and strategic decisions. Proactive communication builds trust and helps to avoid misunderstandings or negative surprises.

Year-round engagement

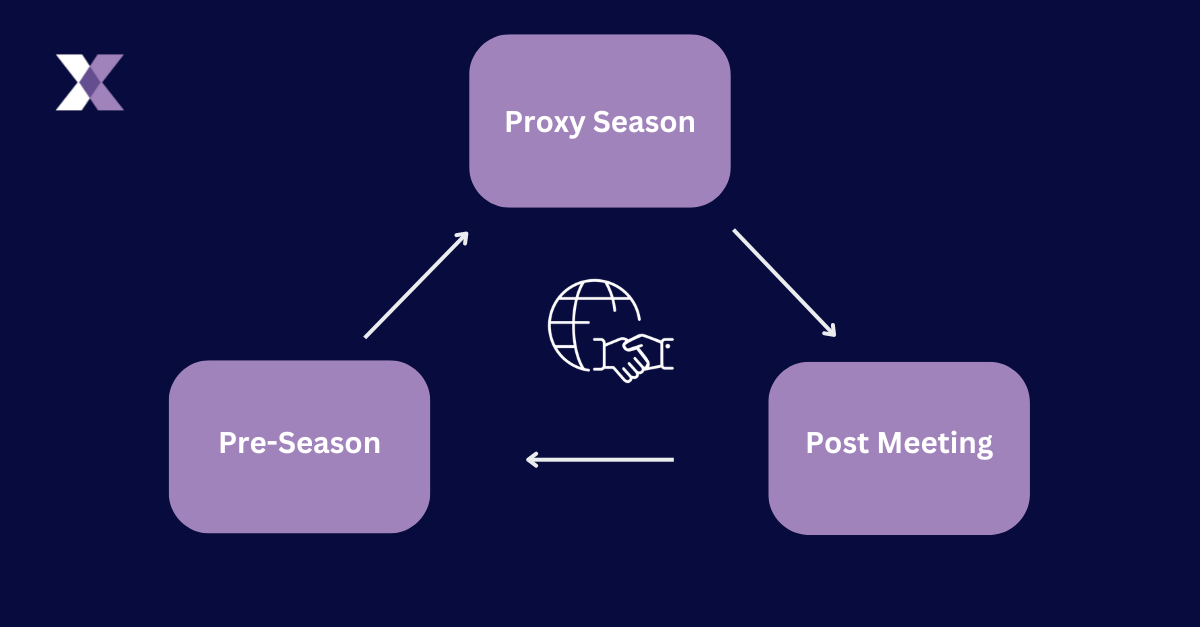

Engagement should not be limited to shareholder meetings alone. A year-round engagement strategy that includes pre-meeting communication, during-meeting interactions, and post-meeting follow-ups ensures continuous dialogue. Regular updates and feedback loops create a sense of inclusion and help maintain shareholder confidence in the company’s governance.

Personalising engagement approaches

Personalising engagement is crucial for effective communication, particularly with institutional investors. Tailoring messages and interactions based on shareholder preferences, concerns, and expectations enhances the quality of engagement and builds stronger relationships. Companies should invest in understanding their shareholders’ needs and create customised strategies for communication and involvement.

Leveraging Shareholder Insights and Vote Insights for key data

Utilising insights from shareholder identification and real-time voting outcomes can provide valuable data for shaping engagement strategies. Learning about your top beneficial owners and movements in share ownership can help drive investor targeting strategies along with tailored engagement efforts for larger shareholders of your stock.

Real-time voting data can be crucial, especially during a meeting, in identifying the biggest influencers of a vote and understanding their reasoning.

This data-driven approach ensures that the company’s decisions remain aligned with shareholder expectations.

Trends shaping the future of shareholder engagement

Driven by key trends, the landscape of shareholder engagement is evolving rapidly. Staying ahead of these changes is critical for companies to build stronger relationships.

Increased focus on ESG

Investors are increasingly focused on ESG factors, which is shaping shareholder engagements and the content of corporate governance discussions. Companies face growing pressure to adopt sustainable practices, reduce their environmental impact, and address social issues like diversity and inclusion. Engagement on corporate governance issues, particularly those related to ESG, is becoming more crucial, with investors demanding enhanced transparency and accountability on these matters.

Technology-driven shareholder interactions

Advancements in technology are transforming shareholder engagement. Virtual meetings, digital surveys, and online platforms for communication are making it easier for companies to interact with investors. These technological tools allow companies to reach a wider audience, streamline engagement processes, and provide shareholders with more convenient ways to participate in decision-making.

Greater regulatory oversight

As shareholder activism and engagement continue to grow, regulators are intensifying their scrutiny of corporate governance practices. Companies must stay informed about evolving regulations related to shareholder engagement, including reporting requirements, voting procedures, and guidelines from proxy advisors. A strong understanding of these regulatory requirements is essential for maintaining compliance and fostering positive shareholder relationships.

Get more advice on shareholder engagement

Shareholder engagement is a vital component of modern corporate governance. By understanding its objectives, methods, key stakeholders, and challenges, companies can develop effective strategies to foster strong relationships with their investors. To learn how our solutions can help you improve your shareholder engagement strategy, feel free to contact us today.