All-in-one disclsoure solution with fully digital, secure and regulatory compliant processing

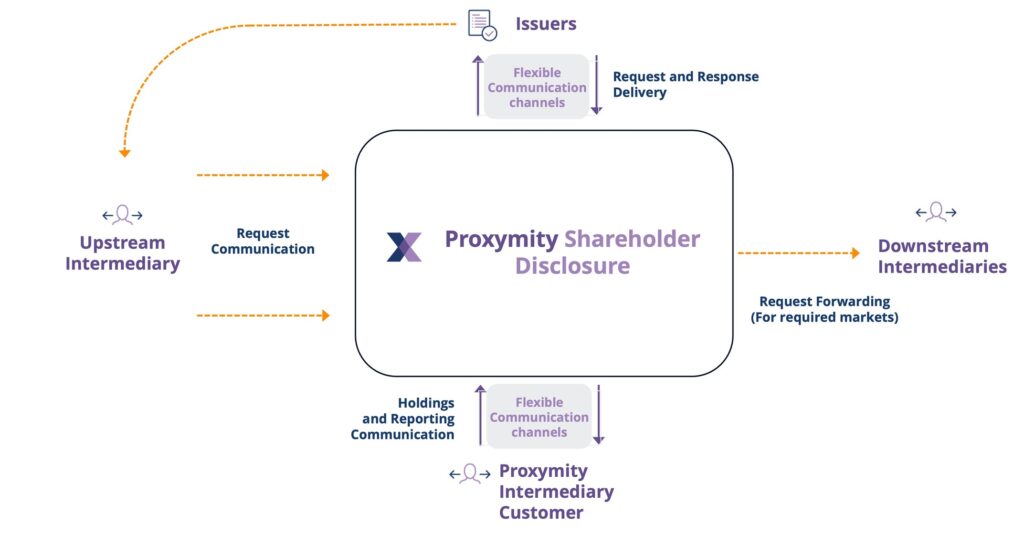

Proxymity Shareholder Disclosure helps custodians, banks and brokers comply with global transparency regulations while minimising cost and eliminating operational hurdles through real-time, digital processing of disclosure requests.

Enhanced security and auditability

with end-to-end encrypted and trackable data exchange

Built-in compliance reporting

providing all necessary data to fulfill internal regulatory obligations

Decrease resource strain

through a scalable and automated high-volume request solution

Eliminate manual processing risks

by utilising full optimisation, reducing operational costs and freeing up internal resources

Recognised for top ‘Innovation in Shareholder Disclosure’, Proxymity is widely seen as an award-winning solution

Real-time compliance and regulatory confidence

- Shareholder Disclosure tracks, logs and reports on compliance status in real-time across all markets with regulatory disclosure regimes, including the EU, U.K, Ireland, Australia, Hong Kong, Malaysia and Singapore

- The solution includes comprehensive online reporting of received disclosure requests and the corresponding disclosure responses

- The automated and real-time processing of requests minimises errors and ensures timely delivery of required data

Automated authentication and data security

- Proxymity’s proprietary technology verifies all disclosure requests from issuers or their agents to ensure both the compliance of the request with local laws and regulations, as well as the authorisation of the agent to act on behalf of the issuer

- Shareholder Disclosure securely transmits sensitive data between authorised parties digitally, removing the risk from emails and other communication methods

Flexible data access and reduced costs

- Shareholder Disclosure offers API connectivity for intermediaries with high request volumes, and an intuitive online user interface for intermediaries with relatively low request volumes

- The platform accepts all formats of electronic messaging for convenient processing of requests

- Direct connectivity across the custody chain and real-time processing reduces operational burden and minimises costs

Highest Security Standards

Proxymity is SOC2 certified, compliant with GDPR and meets all regulatory requirements pertaining to disclosure in every applicable market.

Market Case Study

Mid-size European bank providing services to individuals, professionals, small-medium enterprises, and businesses

Unprecedented visibility and ease in processing disclosure requests

- The Challenge: Delivering a solution for disclosure request ingestion and response delivery based explicitly on the SRD II implementing regulation timelines and format.

- The Solution: Seamless onboarding to the Proxymity Shareholder Disclosure platform in less than 10 business days to efficiently process requests raised by the issuer and submit responses.

- The outcome: The bank gained full visibility into its shareholder disclosure process, enabling electronic, SRD II-compliant requests and responses across EU markets.

The Proxymity Way – Transparent, Secure & Efficient

The Proxymity Difference

- Cost Savings by reducing operational and technological overhead

- Reduced risk by trusted and secure request validation and authentication protocols

- Complete audit trail through real-time status updates via our proprietary dashboard

- Flexibility through acceptance of multiple messaging formats

- Compliant with regulations in all disclosure jurisdictions

Award winning

Global Custodian Magazine

Editors’ Choice ‘Fintech of the Year’

Leaders in Custody Awards 2024

Best Asset Servicing Product in the Market

Best Asset Servicing Technology Product

Asset Servicing Times Awards 2023

Leading Digital Transformation Vendor – Services

Leader in Digital Transformation

Digital Transformation Awards 2023