Views

Retail Investing Trends – Shaping the Future of Corporate Stewardship

In recent years, there has been a significant rise in the number of retail investors entering the stock market. This surge can be attributed to various factors, including advancements in technology, the COVID-19 pandemic, and regulatory changes.

Retail investors, once considered a niche segment, are now taking centre stage and playing a crucial role in shaping the investment landscape. In this article, we will explore the key retail investing trends and the impact of various factors on their behaviour and patterns.

The Rise of Retail Investors

The COVID-19 pandemic and the accessibility of commission-free trading apps have been catalysts for the surge in retail investors. Millions of individuals turned to stock investing to make use of resources and free time. The stock market rebounded quickly after the initial crash from the pandemic, attracting a new wave of young and tech-savvy investors who saw the potential for growth, particularly in the technology sector.

According to Charles Schwab, up to 15% of retail investors may have made their first-ever investment in 2020. These investors are no longer passive participants in the market but active stakeholders who seek to influence corporate decision-making. The democratisation of markets and the amplification of retail investor voices through technological advancements have given rise to a new era of investor engagement.

The GameStop saga in early 2021 exemplified the power of retail investors to influence market dynamics. While the events surrounding GameStop may not represent the typical behaviour of the entire retail investor community, they have undoubtedly influenced the perception of retail investors’ impact on the market.

Retail investors are increasingly making their voices heard, demanding transparency, accountability, and changes in corporate governance practices.

7 Growing Trends in Retail Investing

Retail investing has witnessed significant transformation over the past few years. Empowered by technology and greater access to information, individual investors are now more influential than ever.

Before discussing the factors driving retail investment, here are some emerging trends in retail investing that are shaping the future:

1. Rise of ESG Investing

Environmental, Social, and Governance (ESG) criteria are increasingly becoming a priority for retail investors. Many are choosing to invest in companies that align with their values, focusing on sustainable and ethical business practices. In the U.K. alone, 1 in 10 investors participate in ESG investing.

This shift has boosted the creation of ESG funds, with asset managers globally expected to increase these funds to $33.9 trillion by 2026. Additionally, ESG investing was found to yield better returns, according to 60% of institutional investors. So, this trend is expected to grow as more ESG funds are created in the market.

2. Growth in Fractional Share Investing

Fractional share investing allows individuals to buy a portion of a stock, making high-priced stocks accessible to retail investors with limited capital. This trend democratises investing, enabling more people to participate in the stock market and diversify their portfolios with a smaller sum of money and without taking on a higher risk.

Fractional share investing transactions roughly account for nearly half of the trade volume in the market. While this accounts for just 5% of the total share volume, it is expected to rise as it allows individual investors to easily enter the market.

3. Focus on Cryptocurrency and Digital Assets

Cryptocurrencies and digital assets have captured the interest of retail investors. With the potential for high returns, these assets offer an alternative to traditional investment avenues.

Platforms like Coinbase, Binance, Revolut etc. have made it easier for retail investors to trade and invest in cryptocurrencies. In fact, digital assets represent between 5% and 10% of retail investors’ wealth. The expected annual growth rate of this market is 8% and while institutional investors are entering, retail investors will be driving this growth.

4. Expansion of DIY Investing

Do-It-Yourself (DIY) investing is becoming increasingly popular. With access to a plethora of online tools and resources and the rising trend of fractional investing, retail investors are taking control of their own investment decisions. This hands-on approach allows them to tailor their portfolios to their specific goals and risk tolerance.

As per Boring Money’s Advice Report, there were over 10 million DIY investment accounts opened in the U.K. in Q1 of 2024 alone. This trend shows that retail investors are expected to rely less on paid financial advisory services in the future, especially with the availability of information on the internet and social media.

5. Rise of Thematic Investing

Thematic investing focuses on trends and themes that are expected to drive future growth, such as renewable energy, technology advancements, and healthcare innovations. Retail investors are increasingly looking to thematic ETFs and mutual funds to capitalise on these long-term trends. In the US, the top four themes accounted for 25% of the market’s returns on average since the pandemic. AI thematic ETFs, in particular, have gained a lot of traction among retail investors, increasing by nearly 35% annually in new investors.

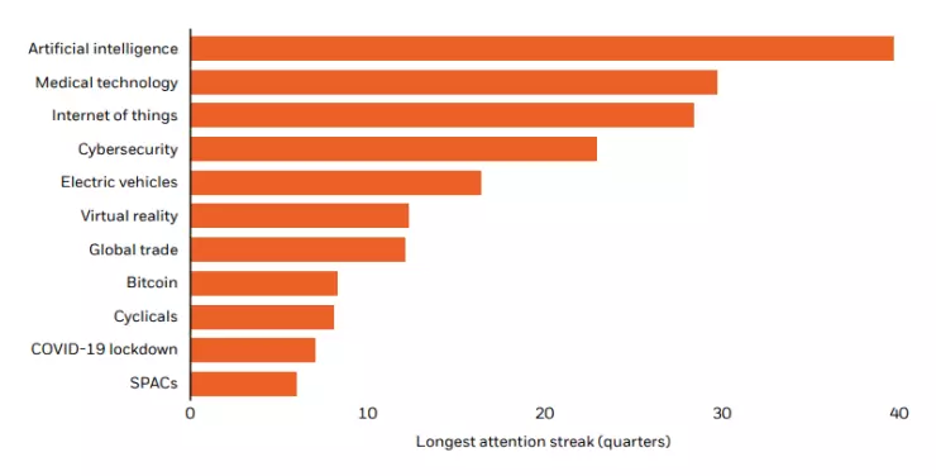

Thematic investing is heavily influenced by the number of mentions in the news, social media, analysts, etc. According to BlackRock’s research, tech-related topics, especially AI, saw a high attention streak post-pandemic.

Source: BlackRock

6. Integration of Social Responsibility and Impact Investing

Retail investors are also showing a keen interest in impact investing, which aims to generate positive, measurable social and environmental impact alongside a financial return. This trend is driven by a desire to contribute to societal change while still achieving investment objectives. The global impact investment market grew by almost 18% to nearly $500 billion in 2023.

A 2019 survey highlighted a demand among retail investors for impact investing. This was further supported by experts like Amit Bouri, CEO of GIIN, who said “All the data is pointing to a great deal of demand amongst the broader population for opportunities to put your money to work, to invest in a better world.”

Sustainable and green investments are also gaining traction among retail investors who are keen on supporting environmentally friendly initiatives. This trend is beneficial for the planet and offers the potential for substantial returns as the market for sustainable products and services grows.

7. Increased Attention to Corporate Governance

As the role of retail investors continues to rise, their investment decisions are influenced by the corporate governance practices in the company as they want to ensure transparency, accountability, and ethical behaviour. This is consistent with the results of a study that highlighted that firm-level corporate governance attributes positively affect retail shareholding levels. A lack of good corporate governance practices by a company can also result in activist campaigns, i.e. buying a significant portion of a stock to exert influence.

To learn more about corporate governance issues that investors care about, have a look at our recent article.

Factors Driving Retail Investor Engagement

Retail investors have distinct motivations and behaviours that set them apart from institutional investors. They are attracted to the stock market for various reasons, including earning passive income through dividends, protecting their money against inflation, and supporting companies that align with their viewpoints. Retail investors also have the advantage of being able to wait for the right market conditions before they invest their money, allowing them to sit out during times of high volatility or uncertainty.

Furthermore, retail investors are increasingly interested in Environmental, Social, and Governance (ESG) investing. They seek to invest in companies that align with their values and are committed to sustainability and social responsibility. This growing interest in ESG issues has prompted retail investors to engage with companies on topics such as board diversity and sustainability. In turn, this has driven regulators to introduce laws that require greater transparency and disclosure of ESG-related information from issuing organisations. In fact, disclosure of ESG news, pertaining to the value of the stock, resulted in higher trading activity among retail investors.

Social media platforms and online forums have also become powerful tools for retail investors. A survey by IR Magazine highlighted that 75% of investors rely on social media to make decisions related to investing. Communities like Reddit’s WallStreetBets have shown how collective action can influence market movements.

Retail investors are leveraging these platforms to share insights and strategies, and even coordinate investment moves. So, it’s no surprise that companies like Ford and CVS use social platforms like X (Formerly Twitter) for investor relations.

Regulatory Changes and Retail Investor Empowerment

On the topic of regulatory changes, many regulations have contributed positively to the empowerment of retail investors. The European regulatory agenda, including MiFID II, UCITS, AIFMD, and the Shareholder Rights Directive (SRD II), has focused on improving investor access to funds, increasing transparency, and granting retail investors more voting rights. These regulations aim to level the playing field between retail and institutional investors and promote retail investor engagement in corporate governance.

The Role of Technology in Retail Investor Engagement

Technology has played a significant role in empowering retail investors and democratising access to the stock market. The rise of digital trading platforms, such as Robinhood and Etoro, has made investing more accessible to a broader range of individuals. These platforms offer commission-free trading and the ability to buy fractional shares, allowing investors with limited funds to participate in the market.

Additionally, the adoption of robo-advisors and automated trading platforms is on the rise. These technologies offer retail investors sophisticated tools that were once only available to institutional investors. With the help of AI and machine learning, retail investors can now automate their investment strategies, reducing costs and improving efficiency.

Furthermore, technology has facilitated real-time communication and interaction between companies and retail investors. Digital platforms, like Proxymity’s Vote Connect, enable investors to attain accurate and timely information directly from the issuing company, ensuring transparency and facilitating shareholder engagement. Retail investors can now have a more active role in voting and decision-making processes.

Learn More About the Future of Retail Investing

The rise of retail investors is not just a temporary occurrence. It is a trend that is likely to persist and shape the future of investment. Retail investor activity will continue to have a significant impact on the market, potentially shifting dynamics between clearing firms, market makers, brokerages, wealth managers, and hedge funds.

To adapt to this evolving landscape, financial institutions need to assess and transform their business models, pricing strategies, and customer experience to cater to the needs and preferences of retail investors. More importantly, they need to adopt the right technology to ensure that they are maximising engagement.

By embracing these trends and adapting to the needs of retail investors, financial institutions can stay ahead and build lasting relationships with this empowered segment.

For a deeper understanding of retail investor trends and effective strategies for engagement, we invite you to download our comprehensive report: Best Practice Report: Rethinking Retail Investors; or contact us to discuss your plans to build engagement with retail shareholders.