Views

Shareholder Activism: How to Navigate the Landscape

The global investor base continues to expand with the increasing involvement of retail investors and an evolution of laws encouraging shareholders to exercise their rights. Accordingly, shareholder activism has surged over the past decade, returning to its pre-pandemic momentum. This trend culminated in nearly a thousand publicly listed companies worldwide facing activist campaigns in 2023. What began as a push for financial returns has now evolved, with activists increasingly championing broader sustainability and ESG (Environmental, Social, and Governance) issues. This shift highlights the growing emphasis on sustainable business practices and the exposure of all public entities to activist campaigns, regardless of their size.

The United States remains the major arena for shareholder activism, but significant campaigns are also rising in Europe and Asia, driven by shareholder-friendly laws and strong market performances. Data from 2023 shows a 4% increase in the number of companies targeted by activists compared to the previous year, with notable activities in Canada, Asia, and the United States. These campaigns address issues such as corporate remuneration policies, environmental impacts and board composition.

European markets, particularly in countries like Switzerland and Germany, have seen a rise in activism due to more shareholder-friendly corporate laws such as the EU Shareholder Rights Directive II which provides voting and engagement rights and removes obstacles to cross-border voting. In Asia, markets such as South Korea and Singapore have experienced marked increases in activist campaigns.

As shareholder activism continues to grow and become a more prominent trend, this guide aims to help publicly listed companies navigate and manage the process effectively, preparing for the challenges and opportunities in 2024 and beyond.

What is Shareholder Activism?

Shareholder activism is where equity investors aggressively exercise their rights to influence corporate decisions. Its origins can be traced back to the 1980s when investors began purchasing significant stakes in companies specifically to exert influence.

Initially defined as ‘greenmailers’ or ‘corporate raiders,’ early activists were often seen as pursuing short-term goals and personal motives at the expense of long-term corporate continuity and interests. However, over the years, activists have significantly rebranded themselves. Today, they are viewed more favourably as investors focused on long-term shareholder value, pushing for strategic changes in companies with underperforming management teams.

For instance, hedge fund Shah Capital recently reportedly ran a campaign against the re-election of three directors and the executive compensation plan. This effort led to the company changing direction, focusing more on shareholder’s long-term value.

How Do Shareholder Activists Operate?

Shareholder activism operates through various mechanisms that allow investors to influence a company’s direction and policies. The process often begins with identifying issues within the company that require attention, such as underperformance, governance concerns, or a lack of transparency. Activist shareholders typically conduct extensive research and analysis to build a compelling case for change.

Once an issue is identified, activists usually engage in dialogue with the company’s management and board of directors. This can involve private meetings, letters, or public statements. If initial discussions do not yield the desired outcomes, activists may escalate their efforts by submitting shareholder proposals. These proposals are voted on at the company’s annual general meeting (AGM) and, while often considered an advisory vote, the results can exert significant pressure on the company to act.

In some instances, activists may propose alternative candidates for the board of directors to replace incumbents they believe are not acting in shareholders’ best interests. In the United States, this approach can be costly and contentious but is a powerful way to achieve substantial change. An example can be in reports about Nelson Peltz’s Trian Fund Management pushing for strategic shifts at Disney by targeting board seats.

Additionally, activists might leverage media campaigns and social media platforms to garner public support and pressure the company. By mobilising other shareholders and stakeholders, activists can amplify their message and increase their influence.

What Are Some Common Types of Shareholder Activists?

Shareholder activism comes in various forms, with different types of activists employing unique strategies to influence corporate behaviour and drive change. Here are some notable types of shareholder activists and recent examples of their campaigns:

1. Hedge Fund Managers

Hedge funds are often at the forefront of shareholder activism due to their significant resources and expertise. Many wealthy individual investors and other private firms exert influence by partnering with or opening their own hedge fund.

They are unique as activists as they approach the company using different strategies with the sole objective of creating maximum returns.

In a recent example, US-based Elliot Associates acquired a 5% stake in The Scottish Mortgage Trust, which reportedly put pressure on them to improve shareholder value.

2. Private Equity Firms

Private equity firms play a crucial role in shareholder activism, often seeking to restructure the management of companies for improved performance, including targeting companies with the objective of taking them private.

They often partner with other organisations through a co-investment initiative on a deal-by-deal basis. For instance, in April of this year, private equity firm Silver Lake reportedly decided to take entertainment company Endeavor private in a $13 billion deal. It was also reported that Endeavor denied minority shareholders the ability to veto the deal to ensure it went through as intended.

3. High-Net-Worth Individuals

High-net-worth individuals can exert substantial influence on companies through their significant shareholdings.

A notable example is American billionaire Bill Ackman, who reportedly led a campaign through his hedge fund, Pershing Square Capital Management, to influence the strategy of Chipotle Mexican Grill in 2016. Ackman pushed for changes in the company’s operational approach and governance to revive its growth and improve financial performance.

4. Institutional Investors

Institutional investors have also been engaging in shareholder activism, often with a focus on long-term strategy, value, sustainability and the rights of shareholders.

Recently CalPERS, one of the largest U.S. public retirement funds, declared that they will vote against ExxonMobil’s board and CEO for filing lawsuits against climate activists, stating that the rights of the investors need to be protected to drive maximum shareholder value.

5. Socially Responsible Investors

Socially responsible investors focus on ethical and sustainable business practices. A recent example is when a group of 27 shareholders, holding a 5% stake in Shell’s stock, reportedly filed an independent resolution demanding the company tighten its climate change targets.

These examples highlight the diverse nature of shareholder activists and provide examples of how they can influence corporate governance and strategy. Each type brings a unique perspective and set of tactics to the table, shaping the future of the companies they target.

When is a Company Likely to Be a Target of Activism?

Shareholder activists often identify target companies based on specific characteristics that suggest opportunities for value enhancement, governance improvements, or strategic redirection. Here are key factors that make a company a likely target of activism:

1. Significant Cash Reserves but Low Stock Prices & Returns

Companies deemed to have inefficient capital allocation strategies are often targeted by activists, especially if the company’s stock price isn’t on par with peers and competitors in the market. Activists may push for share buybacks, increased dividends, or reinvestment into high-growth opportunities. The goal is to optimise the use of capital to enhance shareholder returns and prevent wastage of resources.

2. Declining Financial Metrics

Companies underperforming financially or seen as not fully leveraging their potential for value creation attract the attention of activists. Stagnant or declining stock prices and overall financial performance can negatively impact the market’s perceived valuation. Activists target such companies to accelerate positive financial changes and advocate for strategic decisions that align with long-term value creation.

3. Strategic Misalignment and Operational Inefficiencies

Companies with strategic misalignments or operational inefficiencies often attract activism, especially if they have a history of stellar growth and operate in a lucrative industry.

Activists seek opportunities to drive strategic shifts, streamline operations, or enhance efficiency to unlock shareholder value. They may push for divestitures, mergers, acquisitions, or other strategic moves to better align the company’s operations with its core strengths. Notably, 28% of activist campaigns since 2006 have called for business separations to improve focus and efficiency.

4. Gaps in Corporate Governance and Transparency

Companies with issues in corporate governance structures, or insufficient transparency are prime targets for shareholder activists. Activists are often focused on corporate governance matters that impact financial performance. They seek to improve governance by pushing for changes in board composition, advocating for clearer fiduciary responsibilities, and demanding better risk management practices.

5. Neglect of Social and Environmental Responsibilities

The growing inclusion of ESG factors in investment strategies has made targets of companies that neglect ESG responsibilities. Activists deploy ESG themes in their campaigns to garner attention towards these issues and highlight necessary reforms.

Companies with poor ESG performance are seen as facing significant financial risks, prompting activists to challenge their policies and practices to ensure sustainable business practices and long-term profitability. This trend is further supported by studies that recognise a positive correlation between ESG performance and metric like ROE, ROA and stock price.

By identifying companies with these characteristics, shareholder activists aim to implement changes that drive value, improve governance, and ensure sustainable long-term growth.

How to Build a Strong Defence Against Activist Campaigns?

While companies can’t predict activist campaigns with complete certainty, they can take steps to avoid surprises at their AGM. Here are some ways to prepare.

Identify Potential Activists and Their Priorities

Companies can mitigate activist surprises by proactively identifying and engaging with shareholders. Understanding the shareholder base, monitoring voting trends, and reviewing backgrounds and track records before an AGM can help spot activists’ potential priorities. M&A expert Chris Ruggeri recommends this defence. Leveraging the right technology can be a game-changer.

Solutions like Proxymity Shareholder Insights Suite offer details of the structure of a company’s shareholder base, including visibility of ownership through the intermediary chain and voting trends, enabling companies to prepare effective responses and engage with their investors ahead of the meeting. This regulatory-compliant platform collects reconciled and reliable data from a wide network of intermediaries in the custody chain, enabling issuers and their agents to easily spot trends and analyse their impact.

Review the Business with an Activist Lens

When preparing for shareholder activism, companies should review key areas that might attract activists’ attention. Deloitte’s research on activist campaigns highlighted several considerations:

• Returns to Shareholders: Compare shareholder returns with industry peers.

• Capital Structure: Assess capital allocation strategies and debt levels.

• Commercial Positioning: Evaluate share pricing and identify growth areas.

• Sum vs Whole Analysis: Assess divisional EBITDA and valuation multiples.

• Financial Performance of Units: Evaluate growth, margins, and returns of business units.

• Operational Improvements: Review operational structure for profitability.

• Cash Flow & Balances: Assess cash usage for maximum returns.

• Value Creation: Quantify current value delivered and potential growth strategies.

• Board Structure and Governance: Over 20% of the activist campaign’s objectives in 2020 were focused on changing the board composition. Hence it is crucial to assess board performance and compensation.

With retail investors being more involved in corporate decision-making in the post pandemic era, ESG impact is a significant concern for activists. For example, shareholder proposals on ESG issues increased by over 5% in 2023 in the United States. ‘Say on Climate’ resolutions gathered significant support in regions like the EU and UK. Companies should consider the environmental and social impact of their operations and address ESG concerns to enhance shareholder value.

By addressing these areas proactively, companies can demonstrate a commitment to sound corporate governance and reduce the risk of activism.

Effective Communication and Engagement Strategies

Effective communication with shareholders is essential for navigating shareholder activism challenges. Companies should maintain open lines of communication to keep shareholders informed about strategic directions and governance issues. This includes making available to the public contact information for the IR team, company secretary, and board readily available to the public. Ongoing dialogue helps preemptively address potential concerns that may attract activists. Strategic involvement of board members in communications, particularly regarding executive compensation and corporate governance, adds credibility and engagement.

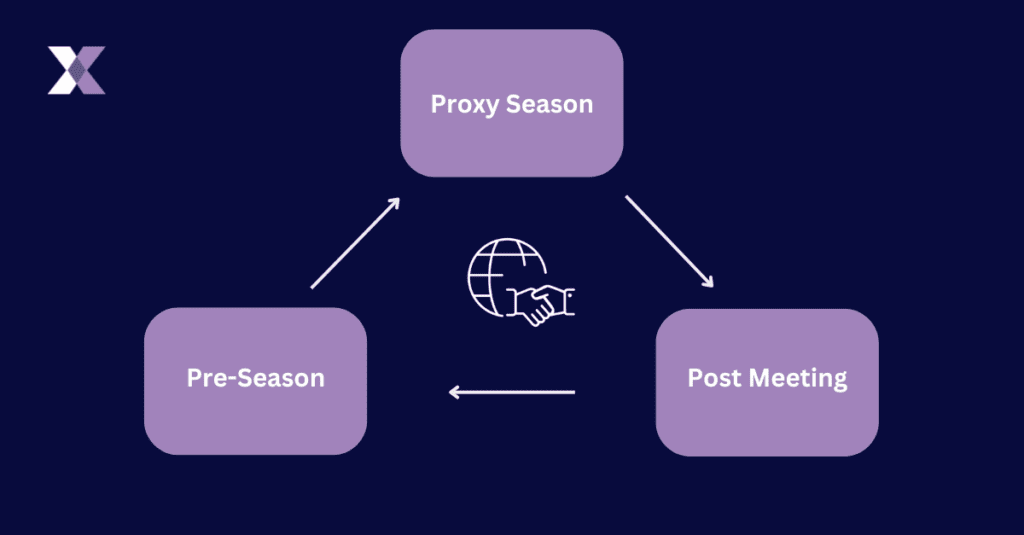

These practices should be year-round, spanning the months prior to the AGM, the AGM voting period and the period of time directly after the shareholder meeting.

Pre-season involves gauging investors’ views on strategy, compensation, and governance. This intelligence is crucial for responding to activists before campaigns become public as they tend to sell after the engagement.

Proxy season is for actively soliciting favourable votes. Receiving early insights into voting trends against a resolution allows issuers more time to understand investors’ reasoning and address their concerns. However, as Proxymity’s COO highlights in his recent article ‘Building investor relationships by leveraging voting insights’, companies today use outdated systems that not only lack transparency but delay the transmission of important information between the issuer and investors.

Solutions like Proxymity Vote Insights provide issuers with crucial voting data in real-time, giving them at least five more days to detect early trends and engage with their investors during peak proxy season.

Post-meeting engagement focuses on collecting input and planning changes. This year-round approach allows companies to engage with investors during the off-season, providing ample time to address major issues.

The Critical Role of the Response Team

Effectively responding to shareholder activist campaigns requires dedicated and skilled representatives from various departments. Key players include senior executives like the CEO and CFO for strategic and financial insight, legal counsel for regulatory navigation, potential litigation risks and rules around inspection of financial records, and investor relations professionals to communicate with shareholders.

Furthermore, corporate governance team members ensure alignment with best practices, while external advisors, such as financial and public relations experts, provide objective analysis and help craft a compelling narrative.

The response should not solely focus on activists’ proposals. Companies should invest 40% of their efforts in demonstrating how their vision and strategies will enhance long-term shareholder value, supported by quantifiable facts. Demonstrating alignment with shareholder ideas and outlining planned changes to meet expectations are key to fostering better relationships with both current and potential future activists.

Learn More About Adapting to Shareholder Activists

As shareholder activism grows and evolves, it is reshaping corporate strategies and governance. This transition urges companies towards transparency, sustainability, and enhanced shareholder value.

To effectively respond to activism, companies must proactively engage with investors, fostering a culture of openness and adaptability. This engagement goes beyond compliance, risk mitigation and activist challenges. It mirrors a broader narrative of change, reflection, and future-proofing, aligning corporate objectives with today’s socio-economic and environmental realities. Furthermore, adopting the right technology can help drive real-time connectivity and enhance engagement with investors.

To stay informed about evolving trends like shareholder activism, retail investors trends and all things proxy voting, sign up for our newsletter today. If you are interested in learning about how Proxymity’s platform can help improve shareholder engagement, contact us for a demo.