Views

The Future of Compliance: Emerging RegTech Trends for 2025

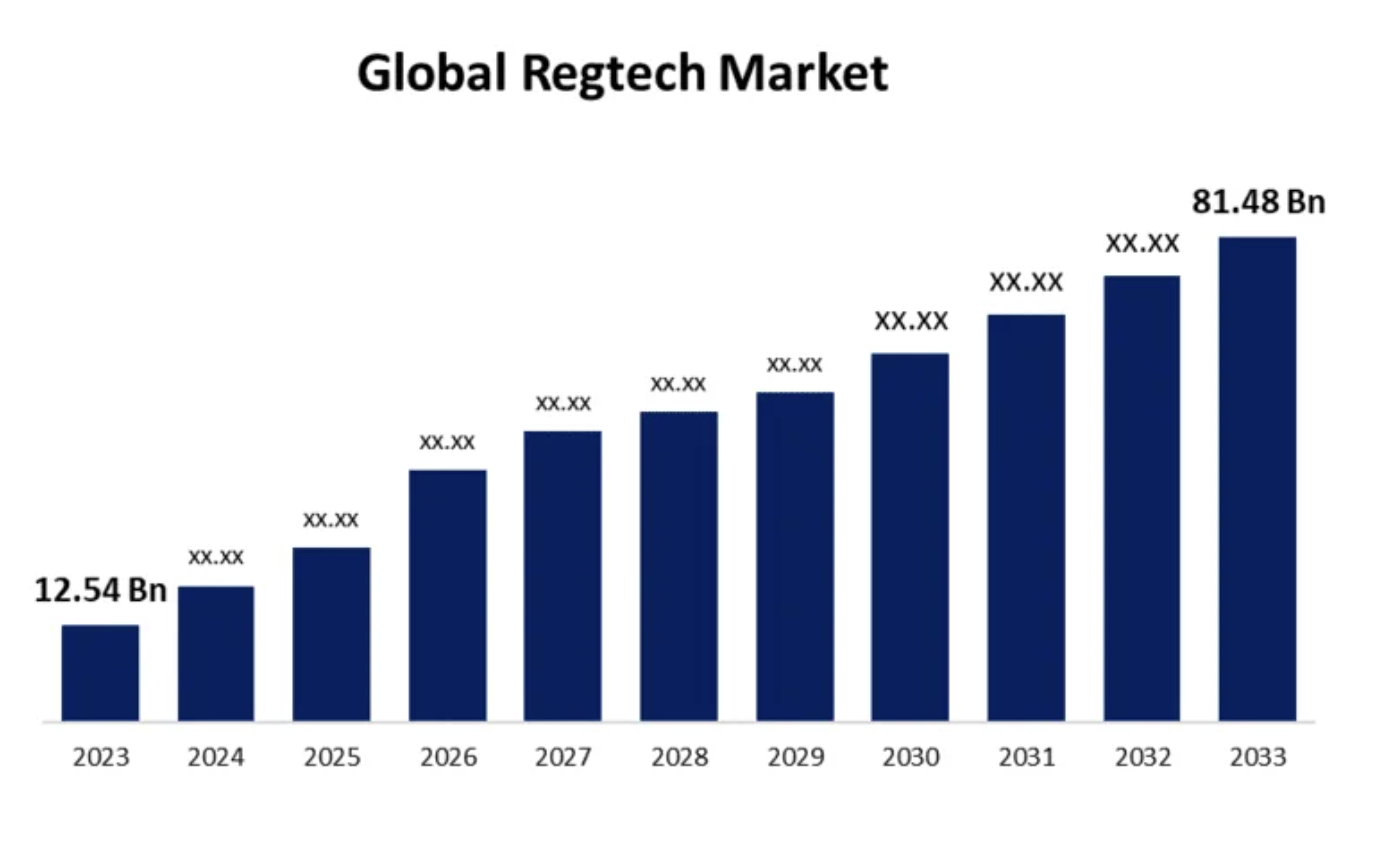

As we approach the end of 2024, Regulatory Technology, or RegTech, has solidified its crucial position in the financial services industry. In an era of constant regulatory change, heightened scrutiny, and the digital transformation of financial institutions, RegTech solutions have become indispensable tools. The market is constantly growing, with the global sales of RegTech estimated to have hit a market value of nearly $13 billion in 2023 and anticipated to reach a value of almost $82 billion by 2033.

Financial institutions are increasingly leveraging RegTech to address some of the top governance issues they face, particularly transparency, accountability, and regulatory compliance. As global regulations evolve, firms must ensure that their governance structures are robust enough to meet new standards. RegTech solutions help streamline governance processes by providing real-time monitoring, enhanced reporting capabilities, and tools to automate compliance checks.

In this article, we explore the key RegTech trends shaping 2024 and the factors driving their adoption in the financial services space.

What are the emerging RegTech trends in 2025?

Regtech solutions reduce operational risks but also ensure organisations maintain the integrity of their governance frameworks while adapting to the complexities of the modern regulatory environment. These are the top trends expected to revolutionise regulatory compliance.

Artificial intelligence (AI) and machine learning (ML) in compliance

AI and ML are transforming all aspects of business, and the landscape of regulatory compliance is no exception. These technologies are playing an increasingly significant role in automating complex compliance processes, such as fraud detection, transaction monitoring, and customer due diligence.

An Industry ARC report recently found the market for artificial intelligence in RegTech is forecast to reach $3.3 billion by 2026, growing at a CAGR of 36.1% from 2021 to 2026. This growth can be attributed to the fact that AI algorithms can analyse vast amounts of data at unprecedented speeds, detecting patterns that human analysts might miss. This is helpful in combating financial crimes.

The ability to process vast datasets quickly and accurately is revolutionising the way compliance departments operate.

AI also enhances the accuracy of compliance checks by learning from historical data and predicting potential compliance breaches. Machine learning models are becoming more sophisticated, reducing false positives in compliance alerts. For instance, AI-powered solutions can help financial institutions monitor customer transactions in real-time, flag suspicious activities and automate the reporting process to regulatory authorities.

Blockchain for regulatory transparency and security

Blockchain technology is another major trend that’s shaping the application and future of RegTech. Blockchain’s decentralised, immutable ledger is particularly valuable for improving transparency and security in financial transactions, which are critical for regulatory compliance. By ensuring records are tamper-proof, blockchain can help organisations maintain the integrity of their compliance data, reducing the risk of fraud and errors.

In recent years, blockchain has been widely regarded as a universal solution to various challenges. However, the prolonged downturn in the cryptocurrency market, coupled with intensified regulatory crackdowns on ICOs, has led some to question the application of blockchain technology.

Nevertheless, there are encouraging developments in the application of blockchain for RegTech solutions, as it is increasingly being used to enhance the efficiency of KYC processes and reduce duplication of efforts across financial institutions.

Blockchain allows customer information to be securely shared between institutions, eliminating the need for multiple verification steps while ensuring compliance with regulations. This not only speeds up the onboarding process but also reduces compliance costs.

Furthermore, blockchain’s ability to provide an auditable trail of transactions simplifies the reporting process, making it easier for regulators to verify compliance. The World Economic Forum predicts that by 2027, 10% of global GDP will be stored on blockchain platforms, further highlighting the growing importance of this technology in the RegTech space.

Cloud-based RegTech solutions for scalability

As financial institutions continue to embrace digital transformation, cloud-based RegTech solutions are becoming the go-to option for scalability and flexibility.

Cloud computing enables organisations to deploy regulatory compliance solutions quickly and efficiently, without the need for extensive infrastructure investments. Currently, cloud-based RegTech solutions are offering unparalleled scalability, making it easier for financial institutions of all sizes to adapt to evolving regulatory requirements.

Cloud solutions also facilitate collaboration between different departments and locations, enabling the seamless sharing of compliance data across an organisation. This is particularly important in a globalised financial landscape, where regulations vary by jurisdiction.

These solutions allow firms to stay compliant with local regulations while maintaining global operational efficiency. According to research by Markets and Markets, the global cloud-based RegTech market is projected to grow from $6.3 billion in 2021 to $16.4 billion by 2026, reflecting the increasing demand for flexible and scalable compliance solutions.

SRD II compliance technology

The Shareholder Rights Directive II (SRD II) has significantly impacted the regulatory landscape in Europe, and RegTech companies are developing solutions to help firms comply with its complex requirements.

SRD II aims to improve shareholder engagement and corporate governance in EU-listed companies. RegTech solutions are enabling financial institutions to comply with SRD II by automating the identification and verification of shareholders, facilitating secure communication between companies and shareholders, and streamlining the process of proxy voting.

Decoding SRD corporate action notices has become a critical function for financial institutions striving to comply with the Shareholder Rights Directive II (SRD II) in 2024. These notices, which communicate key events such as dividend distributions, mergers, and proxy voting, are essential for maintaining transparency between companies and shareholders.

However, interpreting and responding to these notices can be complex and time-consuming. Digital solutions like Proxymity Shareholder Disclosure are streamlining this process by automating the decoding of disclosure notices, ensuring real-time and accurate responses while reducing the risk of non-compliance with SRD II regulations.

These technologies also ensure complete transparency in the process for all participants, essential for maintaining the integrity of shareholder engagement. As SRD II and global shareholder laws continue to evolve, we expect further innovations in RegTech to address compliance challenges.

Data privacy and protection solutions

With the increasing importance of data protection regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), RegTech solutions focusing on data privacy are increasingly gaining traction. Financial institutions are under pressure to ensure that customer data is handled securely and complies with privacy laws.

RegTech providers are offering advanced data encryption, secure storage, and real-time monitoring tools to help firms protect sensitive customer information. AI-powered solutions can identify potential data breaches and unauthorised access, allowing organisations to respond swiftly and mitigate risks.

According to Gartner, by 2024, 75% of the global population will have its data covered by modern privacy regulations, up from 10% in 2020. This shift underscores the growing demand for RegTech solutions that prioritise data privacy and protection.

Real-time regulatory monitoring and reporting

Real-time regulatory monitoring and reporting solutions are becoming increasingly important as financial regulations continue to evolve. In 2024, RegTech platforms equipped with real-time monitoring capabilities are helping firms stay ahead of regulatory changes and ensure continuous compliance.

These solutions allow organisations to monitor transactions and regulatory updates in real-time, reducing the risk of non-compliance. Automated reporting tools can generate and submit compliance reports to regulatory authorities, saving time and reducing the likelihood of human error.

As regulatory scrutiny increases, particularly in areas such as ESG (Environmental, Social, and Governance) investing, real-time compliance monitoring is critical for avoiding costly fines and reputational damage. The ability to respond quickly to new regulations is a competitive advantage for firms in the financial sector.

A notable case study in real-time regulatory monitoring using RegTech can be seen in the Hong Kong Exchanges and Clearing Limited (HKEX) digital transformation project for initial public offerings (IPOs). The project aimed to modernise the traditionally paper-based workflows for IPO listings and issuer disclosures. By developing an integrated digital system that automates the submission and monitoring of data, HKEX significantly improved efficiency and regulatory compliance.

The key features of this transformation included the digitisation of approximately 56 manual forms, saving 75,000 physical forms per year and reducing manual effort by 23 man-days each month. The new system also enabled real-time data validation and disclosure tracking, reducing errors and operational risks, ensuring compliance with listing rules.

This case demonstrates how RegTech solutions can streamline compliance, enhance monitoring, and lower costs while improving transparency and sustainability in financial markets.

The rise of RegTech-as-a-service (RaaS)

RegTech-as-a-Service (RaaS) is a rapidly growing model within the RegTech industry. It offers cloud-based regulatory compliance solutions to financial institutions and other sectors.

By providing regulatory monitoring, reporting, and compliance functions through a service-based model, RaaS allows businesses to adopt these technologies without the need for heavy upfront investment in infrastructure or software development.

The key drivers of RaaS growth have been:

• Increasing Regulatory Complexity: Global financial regulations, such as MiFID II in Europe and the Dodd-Frank Act in the U.S., require institutions to manage vast amounts of data in real-time. As a result, many firms turn to RaaS providers to meet these demands efficiently

• Cost Efficiency: Traditional compliance solutions often involve significant IT infrastructure and manual labour. RaaS reduces operational costs by offering scalable, pay-as-you-go models

• Cloud Technology: The rise of cloud computing has made it easier for companies to deploy RaaS solutions that are accessible, secure, and scalable

The key areas of application for RaaS are:

• Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions are among the top use cases. These systems help financial institutions monitor suspicious activity and conduct customer due diligence without significant manual intervention

• Real-Time Transaction Monitoring: Financial firms can track, report, and ensure compliance with regulations instantly, reducing the risk of fines or penalties for non-compliance

• Automated Reporting: RaaS simplifies regulatory reporting by automating data collection, validation, and submission to regulatory bodies

• Investor Communications: RaaS ensures banks and brokers can maintain regulatory compliance with proxy voting and shareholder disclosure requirements

RaaS is revolutionising how companies handle regulatory obligations by enabling them to remain agile and compliant in an ever-changing regulatory landscape, particularly through automation, AI, and blockchain integration.

Regulatory changes driving RegTech adoption in 2025

The regulatory landscape is constantly evolving, and 2024 is no exception. Several regulatory changes are driving the adoption of RegTech solutions, particularly in areas such as data privacy, AML, and ESG reporting.

New regulations aimed at combating financial crime are placing increased pressure on financial institutions to implement robust compliance frameworks. In the European Union, for example, the Sixth Anti-Money Laundering Directive (6AMLD) requires firms to strengthen their AML controls, and RegTech solutions are proving essential in helping them meet these new standards.

ESG regulations are also gaining traction, with governments and regulators pushing for greater transparency in sustainable investing. RegTech solutions are enabling firms to track and report on their ESG initiatives, ensuring compliance with these emerging regulations.

The role of RegTech in sustainable finance

Sustainable finance is a growing priority for regulators, investors, and financial institutions alike. In 2024, RegTech is playing a pivotal role in helping firms meet their ESG obligations by providing tools for monitoring and reporting on environmental, social, and governance factors.

RegTech solutions are enabling firms to track carbon emissions, measure social impact, and ensure their investment portfolios align with ESG standards.

These tools also help firms meet regulatory requirements related to sustainable finance, such as the EU’s Sustainable Finance Disclosure Regulation (SFDR).

By providing transparency and accountability, RegTech is helping to promote responsible investing and drive the transition to a more sustainable financial system.

Collaboration between RegTech and financial institutions

The collaboration between RegTech and financial institutions is transforming the way entities manage compliance, risk, and regulatory challenges. As the regulatory environment becomes more complex, financial institutions are increasingly leveraging RegTech solutions to automate compliance tasks, reduce costs, and improve efficiency.

Key areas of collaboration include:

• Compliance Automation: RegTech solutions help banks and financial institutions automate KYC checks, AML monitoring, and transaction reporting, significantly reducing the manual labour and time involved

• Risk Management: Financial institutions use RegTech to improve real-time risk assessment, allowing for proactive responses to regulatory changes and minimising non-compliance risks

• Data Management: With the vast amounts of data financial institutions need to process and report to regulators, RegTech solutions offer secure, efficient, and accurate data handling, often incorporating AI and machine learning for predictive analysis

According to Planet Compliance, 90% of financial institutions now use some form of RegTech solution to assist with compliance management. This is due to the multitude of benefits for financial institutions, which include:

• Cost Reduction: RegTech helps institutions cut compliance costs, which have skyrocketed in recent years due to increasing regulations. For example, J.P. Morgan spends $4 billion annually on compliance. Solutions like RaaS can reduce these expenses significantly

• Efficiency and Speed: Automation of compliance processes, such as real-time monitoring of transactions and automated reporting, speeds up operations and reduces human error, improving overall operational efficiency

• Regulatory Compliance: With global regulations constantly evolving, collaboration with RegTech firms helps financial institutions stay compliant in real-time. For example, in 2015 alone, there were 50,000 regulatory updates globally, which can be daunting to manage manually

There have been several notable collaborations to date, including:

• Mastercard partnered with Trulioo to streamline Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, aiming to improve cross-border payment compliance

• Santander adopted ThetaRay’s transaction monitoring platform, which utilises AI and machine learning to detect unusual transaction patterns, helping the bank better manage its AML compliance

The increasing pressure from regulators, combined with the potential cost savings and operational benefits, will likely continue to drive collaboration between RegTech and financial institutions.

6 challenges in adopting emerging RegTech

While the benefits of RegTech are clear, there are several challenges that financial institutions must overcome when adopting these solutions.

Institutions must carefully navigate a range of issues, from ensuring data security to addressing regulatory changes and managing integration with legacy systems.

Furthermore, the cultural shift required within organisations and the readiness of regulators to adopt these technologies add complexity to the process.

This section explores the key challenges financial institutions encounter when implementing RegTech solutions and highlights considerations for successfully overcoming these hurdles.

1) Data security concerns

One of the primary concerns surrounding RegTech adoption is data security. Financial institutions handle sensitive customer information, and any breaches in security can lead to significant reputational and financial damage.

RegTech providers must ensure their solutions are equipped with robust security measures to protect against cyberattacks and data breaches.

2) Navigating evolving regulatory changes

The regulatory landscape is constantly changing, and financial institutions must be able to adapt to new regulations quickly. RegTech solutions must be flexible enough to accommodate these changes without disrupting business operations.

3) Integration with legacy systems

Many financial institutions still rely on legacy systems for their operations, making it difficult to integrate new RegTech solutions. Ensuring compatibility between old and new technologies is a major challenge for organisations looking to modernise their compliance processes.

4) Regulator readiness

While RegTech solutions are advancing rapidly, regulators themselves may not always be equipped to handle these new technologies. Ensuring that regulators are prepared to work with RegTech solutions is essential for their widespread adoption.

5) Change management challenges

Implementing new technologies requires a cultural shift within organisations, and financial institutions may face resistance to change from employees. Effective change management strategies are needed to ensure that RegTech solutions are adopted smoothly.

6) Overcoming third-party risk

Many financial institutions rely on third-party vendors for their RegTech solutions, which introduces additional risks. Ensuring that these vendors meet regulatory standards and can be trusted to handle sensitive data is a key consideration.

Get more advice on RegTech trends

As RegTech advances, staying informed on trends is vital for financial institutions aiming to enhance compliance and reduce risk. Whether implementing AI-driven tools or exploring RegTech-as-a-Service, staying current is key to maintaining a competitive edge in 2024.

By understanding emerging technologies, organisations can make informed compliance decisions and navigate complex regulations more effectively

For more advice on how to stay ahead in the rapidly evolving world of RegTech, consult with experts in the field who can provide tailored solutions for your specific needs.

Proxymity’s real-time platform simplifies and automates compliance processes, making it an ideal choice for issuers, intermediaries and investors looking to stay ahead of compliance.

The platform seamlessly integrates with existing systems, reducing the administrative burden, particularly in areas such as disclosure related compliance, power of attorney and other proxy voting requirements.

To learn how Proxymity can support your compliance needs, contact us today.