Views

Universal Proxy Rules: Insights and How to Adapt

The Securities and Exchange Commission (SEC) implemented the universal proxy rules in 2022 which marked a significant shift in the proxy voting process in the United States. These rules aim to provide shareholders with greater transparency and influence over corporate governance by ensuring they have more comprehensive and comparable information about board candidates. This article will delve into the details of these rules, their implications, and how companies can best prepare for them.

Understanding the Universal Proxy Rules

Here are the details of the universal proxy rules that recently took effect in the market:

Universal Proxy Card

The introduction of the universal proxy card is one of the most significant changes under these rules.

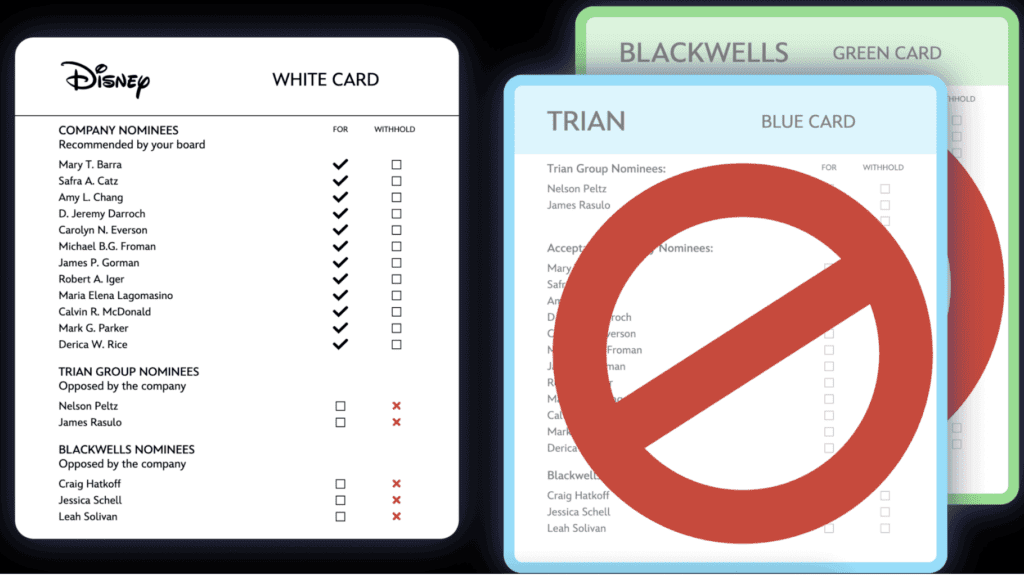

This card allows shareholders to vote for their preferred combination of board nominees, regardless of whether the candidates are proposed by the company or a dissident shareholder.

Previously, shareholders voting by proxy could only vote for the company’s nominees or the dissident’s slate, but not mix and match candidates.

The universal proxy card aims to emulate the in-person voting experience, where shareholders attending a meeting can choose from all nominees on a single ballot. This change is expected to enhance shareholder democracy and potentially alter the outcomes of contested director elections.

Impact on Shareholder Voting

The universal proxy card fundamentally changes how shareholders can express their preferences in director elections. By providing a single card listing all candidates shareholders can exercise their votes more strategically. This change can lead to more diverse board compositions, reflecting a broader spectrum of shareholder interests.

Moreover, it levels the playing field between the company and dissident shareholders, allowing all candidates equal visibility.

Challenges

While the universal proxy card enhances shareholder democracy, it does come with challenges. Companies may face increased campaign costs as they must engage with shareholders more extensively to ensure their nominees are elected.

Additionally, the potential for more contested elections could create uncertainty and instability within the boardroom. However, the long-term benefits of improved governance and accountability are expected to outweigh these challenges.

Lastly, though the universal proxy card requires the listing of both company nominees and dissident nominees, companies and dissidents will demand their candidates be listed at the top. Thus, the practice of differently ordered candidate slates being distributed on different coloured cards is still undertaken.

This results in both companies and dissidents spending exorbitant amounts of money, and shareholders experiencing confusion when presented with multiple voting cards.

Nomination Notice Deadlines

The rules also introduce specific deadlines for the nomination of board candidates. Dissident shareholders must provide notice of their nominations at least 60 calendar days before the anniversary of the previous year’s annual meeting date.

If the annual meeting date changes by more than 30 days compared to the previous year, dissident shareholders must provide their nomination notice by the later of these two options:

• At least 60 calendar days before the new meeting date

• Within 10 calendar days following the public announcement of the new meeting date

Importance of Timely Notice

This requirement ensures that both the company and shareholders have adequate time to prepare and consider the nominations. It also provides a clear timeline for the nomination process, reducing the uncertainty and potential for last-minute nominations.

Timely notice allows for a more orderly and predictable election process, benefiting everyone involved.

Compliance and Strategic Considerations

Companies must update their bylaws and governance documents to reflect the updated deadlines. Dissident shareholders, on the other hand, must be meticulous in their planning to ensure they meet the notice requirements.

Failure to comply with these deadlines could result in the exclusion of their nominees from the proxy card, significantly impacting their ability to influence board composition.

Minimum Solicitation Threshold

To ensure that shareholders are adequately informed about all nominees, the rules stipulate a minimum solicitation threshold. Dissident shareholders must solicit the holders of at least 67% of the voting power of shares entitled to vote in the election. This requirement aims to prevent frivolous nominations and ensures that nominees have a reasonable level of support before being included on the proxy card.

Ensuring Serious Nominations

Meeting this threshold necessitates significant effort from dissident shareholders, ensuring that only serious and well-supported nominations are considered. This measure is designed to maintain the integrity of the election process and prevent unnecessary distractions for companies. It also encourages more meaningful engagement between dissidents and a broad base of shareholders.

Implications for Shareholder Engagement

The 67% solicitation threshold requires dissident shareholders to engage extensively with the shareholder base, promoting a more informed and engaged electorate. This requirement not only elevates the quality of nominees but also enhances the overall discourse surrounding board elections. Companies, in turn, must be prepared to address the concerns and preferences of a more active and informed shareholder base.

Proxy Statement Filing Deadline and Substance

The SEC’s rules set a clear deadline for filing proxy statements. The dissident shareholder must submit their definitive proxy statements by whichever comes later:

• 25 calendar days before the meeting date or

• Five calendar days after the company files its definitive proxy statement

Synchronising Information Delivery

This synchronised filing schedule ensures that shareholders receive all relevant information in time, allowing them to make informed voting decisions. Additionally, the content of these proxy statements must include detailed information about the nominees, their qualifications, and any relationships with the company, providing shareholders with comprehensive and comparable data.

Enhancing Transparency and Comparability

By requiring detailed disclosures about all nominees, the rules enhance transparency and allow shareholders to make more informed choices. The emphasis on comprehensive and comparable information ensures that all candidates are evaluated on a level playing field, promoting fairness and objectivity in the voting process.

Modified Bona Fide Nominee Rule

Under the modified bona fide nominee rule, any candidate for the board must consent to be named in any proxy statement for the meeting. Previously, candidates only needed to consent to be named in the nominating party’s proxy statement. This change ensures that all nominees are willing to serve on the board if elected and prevents situations where a candidate is nominated without their consent.

Ensuring Candidate Commitment

This modification enhances the legitimacy of the nomination process and ensures that all candidates are genuinely interested in serving the company’s interests. It also prevents the inclusion of candidates who may not be fully committed to serving on the board, thereby improving the overall quality of the nominee pool.

Legal and Practical Considerations

Companies and dissident shareholders must obtain written consent from their nominees before including them in any proxy materials. This requirement adds an additional layer of diligence to the nomination process, ensuring that all parties are clear about the commitments and responsibilities associated with board service.

Limited Elimination of the Short Slate Rule

The short slate rule, which allowed dissident shareholders to nominate a minority of board seats while voting for some of the company’s nominees, has been partially eliminated. Under these rules, the universal proxy card provides a more straightforward method for shareholders to vote for their preferred mix of candidates from both the company and dissident slates.

Simplifying the Voting Process

This change simplifies the voting process and enhances the ability of shareholders to influence the composition of the board according to their preferences. By eliminating the need for complex voting strategies under the short slate rule, the universal proxy card promotes more straightforward and transparent voting decisions.

Impact on Board Dynamics

The elimination of the short slate rule can lead to more dynamic and diverse boards, as shareholders are no longer constrained by the need to balance their votes between different slates. This change encourages a more merit-based selection of board members, potentially leading to more effective and responsive corporate governance.

How Will These Rules Change the Investor Landscape?

The universal proxy rules are designed to significantly impact the investor landscape. By providing shareholders with a more direct and flexible voting process, these rules empower them to have a greater say in corporate governance.

When the rules were proposed, they were expected to reduce costs and increase proxy fights. However, after the first AGMs under these rules, costs rose as full packages were preferred for distribution by both dissidents and companies in a proxy fight. The SEC estimated activists’ median solicitation costs were $750,000 from 2017 to 2020, while dissidents’ median costs were $14,000, with an additional $5,400 to meet the 67% threshold.

Despite expectations, activists continue to deliver full proxy materials. For example, Icahn Partners reportedly spent $700,000 during its Illumina campaign and Politan Capital Management spent $4.5 million on solicitation and $16 million on litigation in its Masimo contest.

Post 2020, the average cost disclosed by activists increased from $1.2 million to $2.7 million while the median stayed about the same.

Here are some of the other key changes we can expect:

Increased Shareholder Activism

With the ability to vote for a combination of nominees from different slates, shareholders are likely to become more active in influencing board compositions. This increased flexibility can lead to more diverse and dynamic boards, potentially driving better corporate performance and accountability.

For instance, Diffusion and the activist group LifeSci Special Opportunities Master Fund Ltd (LifeSci) used a universal proxy, reportedly leading to a settlement where Diffusion agreed to appoint a LifeSci nominee to the board if no specified transaction occurred by July 2023.

For more information on this trend, read our recent article on shareholder activism.

The rules empower shareholders by giving them more control over board elections, aligning with the broader trend of increasing shareholder influence.

More Informed Voting Decisions

The rules ensure that shareholders receive comprehensive information about all nominees, allowing for more strategic and considered votes. This transparency promotes greater shareholder engagement and enhances decision-making.

By reducing information asymmetry, the rules ensure that shareholders can make fair and informed choices, which can drive better corporate governance and improve overall company performance.

Potential for Increased Contested Elections

The ease of nominating candidates and the requirement for detailed proxy statements may lead to more contested elections. This could result in more frequent changes in board compositions and potentially more challenging governance environments for companies. While contested elections can introduce new ideas and perspectives, they also require companies to invest significant resources in managing election campaigns and addressing shareholder concerns.

Greater Engagement from Retail Investors

The universal proxy card simplifies the voting process, making it more appealing to retail investors and potentially increasing their participation in corporate governance.

This shift could lead to a more democratised decision-making process and greater representation of small shareholders’ interests. For insights on retail investor trends, read our recent article on the topic. Increased participation from retail investors can result in more representative and balanced board compositions, reflecting a broader range of shareholder interests.

Overall, the universal proxy rules are likely to enhance shareholder engagement and influence, leading to more responsive and accountable corporate governance.

How Can Companies Adapt to the Universal Proxy Rules?

To navigate the universal proxy rules effectively, companies need to adopt proactive strategies. For tips on navigating and staying ahead of regulatory changes, have a look at our latest article on SRD corporate action notices. Here are some steps companies can take to prepare:

Review and Update Governance Practices

Companies should review their governance practices and make necessary adjustments to comply with the rules. This includes revising nomination procedures, proxy statement content, and shareholder communication strategies. Ensuring compliance is essential for maintaining investor confidence and avoiding regulatory penalties.

This process may involve consulting with legal and governance experts to identify and address any gaps or deficiencies. Adapting to these norms requires fostering a culture of transparency and accountability, revising internal policies, and promoting a more inclusive and responsive approach to governance.

Engage with Shareholders Early and Often

Proactive engagement with shareholders helps companies understand their concerns and priorities. Regular communication builds trust and support, potentially reducing the likelihood of contested elections. Building strong relationships with shareholders is critical to maintaining their confidence.

Companies should engage through regular updates, meetings, and consultations, identifying potential issues early and addressing them proactively. As highlighted in our article on shareholder activism, engagement needs to be a year-round process:

• Well in advance of the shareholder meeting’s voting period to understand shareholder voting intentions and expectations.

• During the shareholder meeting’s voting period to understand shareholder reasoning; and

• After the shareholder meeting to strategise on future plans and investor retention

Leveraging technology can enhance shareholder engagement, facilitate communication, and provide timely and relevant information through digital platforms. Solutions like Proxymity’s Shareholder Insights for Issuers and Shareholder Disclosure for Intermediaries can provide in-depth voting trends in real time with unmatched accuracy and efficiency.

Enhance Board Composition and Diversity

Ensuring a diverse and skilled board can make the company more attractive to shareholders and reduce the appeal of dissident nominees. Companies should focus on recruiting board members with the expertise and perspectives needed to drive success.

Prioritising diversity in board recruitment efforts, considering factors such as gender, ethnicity, experience, and expertise, brings a wider range of perspectives and insights, enhancing decision-making and promoting innovation. Highlighting the qualifications and contributions of current board members is essential for gaining shareholder support, emphasising how they align with the company’s strategic goals.

Prepare for Contested Elections

Companies should prepare for the possibility of contested elections by developing strategies for effective communication and engagement with shareholders. This includes creating clear and compelling proxy statements that highlight the qualifications and contributions of the company’s nominees. Effective communication, with consistent narratives across all channels, is critical for managing contested elections Engaging key stakeholders, including institutional investors and proxy advisory firms, can help build support for the company’s nominees.

Leverage Technology

Utilising technology platforms for shareholder engagement and proxy solicitation can streamline the voting process and enhance communication. Digital solutions like those offered by Proxymity can simplify the proxy voting process and enhance transparency.

Companies can use online platforms to distribute proxy materials and meeting agendas, collect votes, and engage with shareholders, ensuring all shareholders have access to the same information. Enhancing transparency builds shareholder trust and confidence, providing real-time access to relevant information and updates and promoting more informed decision-making.

By taking these steps, companies can better navigate the regulatory landscape and maintain strong governance practices.

Learn More About the Universal Proxy Rules

The universal proxy rules represent a significant shift in the proxy voting process, aiming to enhance shareholder democracy and improve corporate governance. As these rules take effect, it is crucial for companies and shareholders alike to understand their implications and stay ahead of such regulations.

Engaging with professionals who have a deep understanding of the these regulations and leveraging robust technology can provide valuable insights and strategies for compliance and effective shareholder engagement.

To navigate these changes successfully and foster transparent, efficient and accurate governance, contact us for more information about our solutions.